Answer: No. Never use a car damage estimate app to send collision photos of your car damage for an insurance estimate after an accident. If you don’t want to get screwed by your insurance company after a car accident, a car damage estimate app is one app you shouldn’t download.

You have a legal right to have a licensed damage appraiser inspect your car at the auto body shop of your choice. Take advantage of your rights.

Tip: Bring your car to your auto body shop and let the auto body shop call your insurance company to request an appraiser. If you call your insurance company, tell the rep that your car is at your body shop, and then bring your car to the shop immediately.

Note: This article provides unbiased information. 1-800-HURT-911®, LLP is a New York Law firm representing people injured in an accident in New York. We only help people with collision damage claims when they have been injured. If you were not injured, get a collision damage estimate from your body shop, and don’t use a collision damage estimate app.

How Insurance Companies Get You to Use Damage Estimating Apps

Insurance companies enlist news agencies to promote using their appraisal apps. CNBC wrote in their article, Instant insurance claims—apps for your car crash, “Next time you’re in a fender bender, there’s good reason to have your phone on hand—it could speed up your insurance claim.”

Allstate, Esurance, Liberty Mutual, and State Farm advertise how quick and easy they make it for you to get your car repaired after an accident by using their insurance estimate app.

Just take a photo with their insurance claim estimate app, and they’ll send you a check!

But should you send your photos? Insurance companies developed the collision estimate app and this brilliant marketing idea to save them a lot of money. And it won’t even make it easier for you!

Take a picture of the damage, but don’t send it to your insurance company for an estimate. Bring your car to a body shop.

Making Your Life Easy With a Photo Estimate App Only Sounds Great

Will it make your life easy if your car insurance company sends you a check to fix your car? No, because

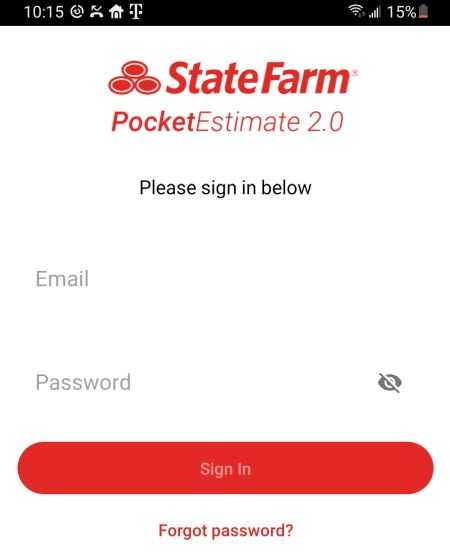

This is a screenshot of the State Farm photo estimate app

after you get a check, you still have to take your car to the body shop. Using the auto claim appraisal app won’t magically fix your car.

The estimate app only lets you get a check before you go to the auto body shop, but your body shop doesn’t need the check before you get there. So, using an appraisal app won’t save you any time.

What about the GEICO Easy Photo Estimate App? GEICO’s tagline says, “GEICO Easy Photo Estimate App: Insurance Made Easy.” But again, it only seems easy. Using the photo estimate app can actually make more work for yourself and cost you time, aggravation, and money.

After you get to your auto body shop, you’ll find your check isn’t enough to fix your car, and you just wasted your time and possibly made things worse.

How Will a Photo Estimate App Make Things Worse?

1) The body shop will have to reopen your claim to get approval for more money. This will delay your claim even longer because it’s tougher to get approval for more money once your insurance company has already under-evaluated your claim.

2) You may not be able to get your insurance company to pay what is needed to fix your car. See this question on Quora from an unfortunate car owner who used State Farm’s photo estimate app, “…I went through their insurance’s photo estimate app (State Farm) and they gave me a $883 estimate. I also got an estimate from my repair shop which is accurately around $4500? What should I do now?”

3) When you’re paid less than you need to return your car to its pre-accident condition, your car will have diminished value.

4) If you were injured, sending collision damage photos to your insurance company can hurt your claim. I have seen insurance companies provide photos showing little damage to No-Fault doctors to deny a No-Fault claim.

Continue reading below this section

![]()

Injured? Call 1-800-HURT-911® New York’s Personal InjuryDream Team™ right now 24/7 for your free consultation to protect your rights!

Injured? Call 1-800-HURT-911® New York’s Personal InjuryDream Team™ right now 24/7 for your free consultation to protect your rights!

We’ll call you back within minutes!

1-800-487-8911

No Win — No Fees

— GUARANTEED! ™

See how Nyda got her dream house! What will you do with your settlement money?

What Can Happen When You Use an Insurance Claim App?

- You may get paid a lot less than the cost of the damage, possibly as much as 8-10 times less.

- The body shop will probably not be able to fix your car for the amount you were paid, so they will have to reopen your claim and wait for an appraiser to come to look at your car.

- Because you already submitted photos and your insurance company now thinks you have a minor claim, you just made negotiating more difficult for your body shop, and they may have a fight on their hands. This can delay your claim even further.

- You may get a check for $1,200 and decide to keep the money without fixing the car, but there could be thousands of dollars of hidden damage you weren’t paid for.

- If you keep the money without fixing your car, you could devalue your car by thousands of dollars. You won’t even know until you try to sell your car and find it’s worthless.

- If you keep the money without fixing your car, you could be driving a car that isn’t safe and shouldn’t be on the road.

See how Allstate paid this woman only $1,730 for damage that cost $11,667 to fix

What’s Easier Than Using an Insurance Estimate App?

Let your body shop make your life easy, and let them fight with your insurance company so you’ll get the right amount of money needed the first time. Many body shops will even get the other car’s insurance company to pay for your damage.

- Take your car to your auto body shop immediately.

- If your car isn’t driveable, call your body shop. They will tow your car.

- Call your insurance company and tell them to look at your car at your auto body shop.

- Never send photos of your car’s damage to your insurance company.

- Never let your insurance company look at your car at your house.

- If you’re injured, call a personal injury lawyer immediately.

That’s easier than using an insurance collision damage estimate app!

Insurance Companies Use Damage Appraisal Apps to Save Money Three Ways

- The insurance companies don’t have to pay appraisers whose job it is to report every detail and every part that has to be replaced or repaired.

- Because they’re not using an appraiser, the insurance companies can pay you less money. People have reported receiving as little as 10% of what they needed to fix their cars.

- They use the photos to show there was very little damage in case you’re injured. Many of our clients have been seriously injured when there was very little damage. See if you can sue for injuries when there was no damage to the car.

How can you be sure that you won’t get enough money to fix your car if you send the collision damage photos to your insurance company?

Simple. How can anyone tell from photos what damage you have underneath the sheet metal and what damage might exist that isn’t seen in your photos?

Allstate advertises their QuickFoto Claim app “helps you get paid quicker so you can get back to normal faster.” But how can you tell if the radiator and other parts under the hood, other parts, or the frame were damaged? You can’t!

When you take your car to a body shop after using a collision damage estimate app, it can take a lot longer to get your car fixed. You’ll wait while your body shop fights to get the money needed to fix all the damage to your car that wasn’t approved with the estimate app.

Save yourself a major headache. Instead of using a collision damage estimate app, take your car to your body shop and let your body shop get the insurance company to approve their estimate.

Watch FOX 61 and Tony Ferraiolo of a state Auto Body Association and see the problems you might encounter if you use an insurance accident app!

Why Do Insurance Companies Want People to Use an Estimate App?

Because many people will take a photo of the damage, get a check, and take the money without ever going to a body shop to fix the car. They will never know that they got paid thousands of dollars less than the insurance company should have paid.

What to Do if You Already Used an Estimate App and Didn’t Get Enough Money

Find a body shop that will fight for you. The body shop will have to get the insurance company to send an appraiser, and hopefully, your body shop will get the money needed to repair your car.

If you can’t find an auto body shop to fight for you, you can look for a general practice lawyer if there are several thousand dollars of damage you’re not getting paid for. But it’s usually too expensive to pay a lawyer to get money to repair a car.

If you were injured, find a personal injury lawyer who is also willing to represent you for the collision damage.

You can sue your car insurance company in small claims court. In small claims court, you do not need a lawyer. In fact, in New York, only one side can have a lawyer in Small Claims Court. Since the insurance company has to have a lawyer, you cannot.

Do You Have to Use the Other Insurance Company’s Estimator App?

Note: If you weren’t injured in a car accident in New York, we cannot help you.

We received a chat message asking the following question:

Visitor: My vehicle was parked on a job site and a contractor that works for the company, subcontractor not with our company, hit my vehicle while turning around and his insurance company is terrible with communication and now is trying to get me to use an estimator app for damages. Meanwhile I’m driving my partially disabled damaged vehicle. Do I have to use their estimator app?

The answer is no. You are not required to use the estimator app from the insurance company of the other driver.

What should you do if the other driver’s insurance company wants you to use their estimator app? Bring your car to your auto body shop and tell the other driver’s insurance company to see your car at your auto body shop. Even better, ask your auto body shop if they can contact the other driver’s insurance company for you.

Please share this important article about insurance estimate apps on social media and leave a comment below!

![]()

You might also be interested in reading:

More Do’s & Don’ts of what you should do after a car accident

Do I have to notify my insurance company when I have an accident but there was very little damage to my car?

See how you can get screwed by your insurance company when replacing a windshield on a leased car.

How to Use An Insurance App to Buy Insurance

![]()

Phil Franckel is a well-known personal injury lawyer in New York since 1989. He is a Founding Partner of 1-800-HURT-911, LLP®, the Personal Injury Dream Team™, and a former Member of the Board of Directors of the New York State Trial Lawyers Association. He has an Avvo Top 10 Rating, Avvo Client’s Choice Award with all 5-star reviews, Avvo Top Contributor Award, Multi-Million Dollar Trial Lawyers Award, and others. See Mr. Franckel’s bio for areas of expertise.

![]()

Get the 1-800-HUR-T911® Dream Team™ on your side and become a member of our family!

We’ll immediately protect you from the insurance companies!

“Knowing I had a team of great lawyers on my side gave me a sense of power and peace of mind. They took care of everything for me. When a settlement was negotiated, I saw the difference a team of lawyers makes.”

—Lia Fisse

No Win — No Fee — No Expenses — Guaranteed!

Attorneys who can get you the most amount of money AND provide personal service!

Please take a look at some of our:

What will happen when I call 1-800-HURT-911 or chat?

- Our call center operators and chat operators are available 24/7.

- Just give your contact info to our operator and Founding Partner Rob Plevy, Esq. will call you within 5-10 minutes for your free, no-obligation consultation during the hours of 8 am – 10 pm. After hours, Rob will call you in the morning or at the time you want.

- Then just text or call us any time you want during your case!

Because any delay could cause you to lose viable rights and benefits, please call HURT-911® Founding Partner Rob Plevy, Esq. right now for a free consultation to find out your rights days/nights/weekends.

1-800-HURT-911

1-800-487-8911

You can speak, text, or email with us whenever you want throughout your case and afterward, days/nights/weekends, and experience our famous personal service. You’ll even get our personal phone numbers so you can call or text anytime!

Watch Founding Partner Phil Franckel, Esq. talk about New York Serious Injury Attorneys.com, difficult cases, and the 1-800-HURT-911® Dream Team™

Philip L. Franckel, Esq. is one of the HURT911® Dream Team™ Founding Partners at 1-800-HURT-911® New York; He has a 10 Avvo rating; Avvo Client’s Choice with all 5-star reviews; Avvo Top Contributor; and a former Member of the Board of Directors of the New York State Trial Lawyers Association.

Founding Partner Rob Plevy, Esq.

Robert Plevy, Esq. is one of the HURT911® Dream Team™ Founding Partners at 1-800-HURT-911® New York. Rob began his legal career in 1993 as an Assistant Corporation Counsel defending The City of New York against personal injury lawsuits.

Get the HURT911® Dream Team™ on your side!

Call Attorneys Rob Plevy & Phil Franckel days/nights/weekends for a free consultation

1-800-HURT-911

1-800-487-8911

![]()

Attorney Philip L. Franckel, Esq., personally authored this page and all articles on NYSeriousInjuryAttorneys.com.

Attorney Philip L. Franckel, Esq., personally authored this page and all articles on NYSeriousInjuryAttorneys.com.